Insurance is the act passing of the risk of loss to someone else to protect against financial loss. The insured party pays the insurer a premium at an agreed-upon interval in exchange for an insurance policy, the premium is normally a small amount compared to the cost of the item being insured. The goal of insurance is to make sure the insured does not suffer financial loss and life goes on as usual after an incident that could partially or fully damage the equipment being insured. The insurer pulls together funds from various insured parties then indemnify/compensates insurance policyholders in case of an incident that requires them to do so. It is based on a probability that not all policyholders will face such a situation requiring compensation at once. Insurance gives peace of mind to policyholders at a relatively small premium.

That was a quick lesson on insurance and how It works, we’re back to phones. Phew!

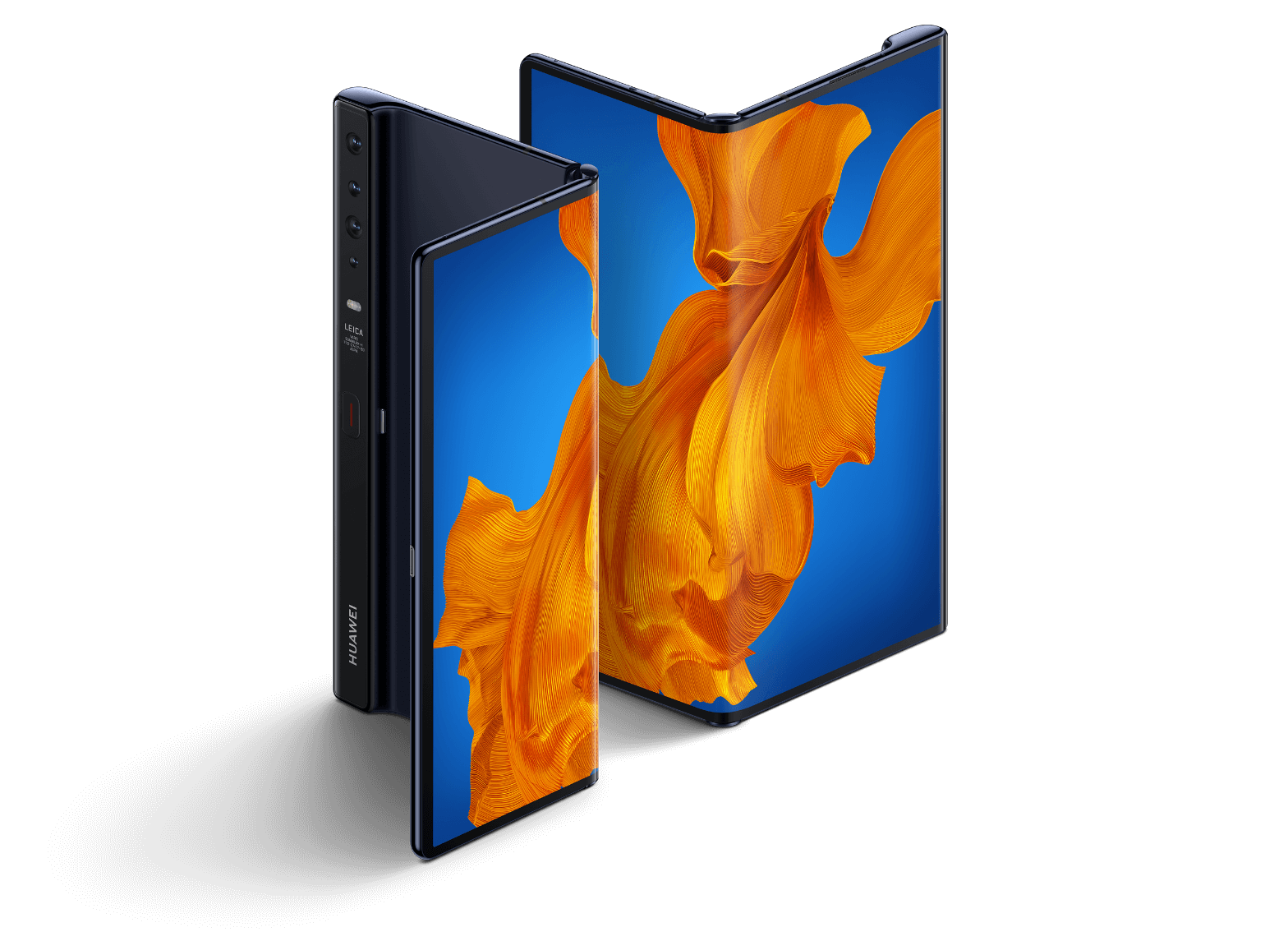

Smartphones are nowadays quite expensive because they are quite powerful and brands always get away with charging a lot because there are people willing to pay, as they use them to make money or purely for entertainment; music, and video. With such an investment comes uncertainties like losing, damage, or just a malfunction after the warranty period from the manufacturer ends. Insurance can cover the repair and replacement of the smartphone in full or part when subscribed to an insurance policy.

It is normally recommended to buy insurance immediately after you purchase a new device since you are not used to the weight and a different design and may slip and break the display or back glass. These can go up to $500 to repair yet the insurance plan is typically under $20 per month. Imagine sinking another $500 a month after spending $1,200! That will most likely hurt. Consider getting insured for about 4 months when purchasing the device then cancel when you are used to handling it.

Device manufacturer

Manya times when purchasing a device from Samsung, Google, Apple, or other manufacturers, you are presented with an option to add protection after the device warranty expires. They normally brand it like an extended warranty. Apple has AppleCare+ with a premium of $9.99 per month and Samsung has Samsung Care+ with a premium of between $3.99-$39.99. This is a form of insurance plan.

Retail sellers

Retail sellers like Amazon have an option to add insurance plans payable once or monthly during checkout. Amazon as of the time of this writing uses Asurion Cell Phone Insurance plan. When you are in need of the service, they will give you instructions on how to get repair of full or partial compensation.

Carrier plans

This is probably the most common way of insuring your phone as it can be bundled with your monthly bill. AT&T, Sprint, Verizon, and more offer these services. Visit or call their respective agents to sign up and protect your device from accidental damage.

Independent companies

Some companies offer independent insurance for your smartphone and other smart devices. These companies include Asurion, Assurant, akko, Progressive, SquareTrade, and more.

From the research I did, Asurion has the best smartphone insurance plans as they only charge $12 – $15 per month per device or $45 per month for multiple devices.

Remember safety always starts with you. Insurance only covers physical damage or loss, for threats that emerge from the internet, you will need a VPN to secure yourself from threats that emerge from the internet.